Environmental, Social, and (Corporate) Governance ESG, Effluent treatment Practices to improve ESG profile

The pursuit of sustainability is altering our lifestyles. In recent years, environmental, social, and governance (ESG) issues have dominated many investment decisions. In addition to benefiting the environment and making society more equitable and inclusive, evidence shows that investment made with sustainable financial analysis actually provide superior returns to investors. Sustainable finance is the method of taking environmental, social, and governance issues under considerations while making investment decisions, leading to long-term investments in sustainable economic projects and programs. Its growth has been fuelled by investors’ desire to have an impact on the environment and society in addition to the financial performance of their investments.

In recent years, businesses have raised their responsible investing considerably. The Environment, Social and Governance (ESG) metric is one of the instruments from this development. Investors who evaluate a company’s style of doing business, as well as its influence on the environment and engaged people, use ESG ratings to grade it. These scores are based on factors in the environmental, social, and governance categories.

- Environmental

Environmental factor comprises of rating the company’s ability in conservation of natural resources and biodiversity. Some of the prime examples of factors considered for evaluating company’s E in ESG are usage of type of energy sources, water and waste management system, control measures for air or water or effluent pollution emerging from its activities, deforestation/afforestation activities, and action and initiatives on climate change issues.

- Social

The social factor evaluates businesses impact on various stakeholders and concerned people. This factor delineates company’s action and performance towards client satisfaction, their data privacy and protection, gender and diversity in workforce, labour rights, employee relations, and its community engagement.

- Governance

A set of governance standards must be followed when running a firm. In the context of ESG, governance refers to how a company is run by those in positions of power at the top. Do the company’s senior management and board of directors look out for the interests of the company’s many stakeholders, such as employees, suppliers, shareholders, and customers? Their policies against instance of bribery and corruption or lobbying are some of the factors evaluated.

Our planet’s resources are limited, and protecting them through operational transparency helps to ensure the long-term viability of your facility and community. Stakeholders and investors are now frequently using non-financial elements like these for their analysis to identify major risk and growth opportunities in their investments. Currently, ESG information must be reported mainly because of stock exchange listing criteria, national mandates, responsible investment guidelines, and pension regulations.

In order to make it easier to incorporate these factors into the investment process the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-related Financial Disclosures (TCFD) are some of renowned entity working towards development of such standards and define corresponding materiality. A materiality analysis is at the centre of every ESG strategy for a company. It looks at what elements organisations should prioritise and where time and resources should be spent: external stakeholder importance and company and internal stakeholder importance. To do a materiality study, you’ll need to collect a lot of data from both internal and external sources.

The most common factors that arise in materiality analysis of manufacturing and processing industries are its water and waste water management. According to recent UN Principles for Responsible Investing reports, investors are now incorporating environmental, social, and governance (ESG) and water considerations into portfolio management due to a variety of factors. They are focused on a wide range of water issues that are not only important to the long-term financial performance of their investments, but also have the potential to help preserve the water resources that are essential to the development of strong economies, markets, and communities.

Investors, ranging from stockholders in industries with significant water implications to owners of physical assets like commodities, real estate, farmland, and infrastructure to debt or equity holders in government entities or corporations face material, physical, regulatory, and reputational risks (as well as some opportunities) as a result of water concerns. Water effluents discharged to subsurface waters, surface waters, or sewers that lead to rivers, oceans, lakes, wetlands, treatment facilities, and groundwater can be part of Water Metrics criteria for some investor. Investors also take into account a company’s disclosure about wastewater discharge by location, treatment technique, and quality, as well as disposal method or location when employing certain effluent characteristics.

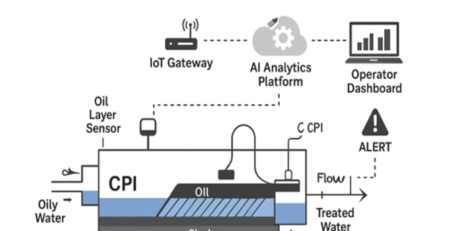

Investors prioritize water risk issues in susceptible industries due to the importance of water for particular firms and operations. Water usage in the manufacturing process, water usage in products, water usage in operations, and water supply in economic development are the most relevant sectors, which can be classified under four key water-related credit issues. This becomes major concern for the industries which require water for most of their upstream as well as downstream processes. Wastewater is produced by a wide range of industrial activities and contains a diverse range of contaminants. To remove these pollutants, effluent treatment technology is available and is only limited by its cost-effectiveness in specific industrial scenarios. The Effluent Treatment Plant guarantees that contaminated and polluted water from industry is treated and reused before being released back into the environment. ETPs (effluent treatment plants) for textile effluent treatment, assure investors of the industry’s commitment to reduce fresh water use in its plants and discharge/dispose within regulatory limits, as evidenced by their use of recycled and reused water in their sustainability reporting disclosures. Organic matter, inorganic matter, heavy metals, oil and grease, suspended solids, and other contaminants are removed by a wastewater treatment process in a well-designed ETP or Effluent treatment plants. Batch or continuous flow ETP methodologies in Effluent recycling plants are available wastewater recovery. These wastewater treatment systems can help you save energy and remove pollutant effluent in a cost-effective manner while also meeting government criteria. Many investors are taking proactive steps to mitigate these risks and take advantage of climate-resilient investment opportunities that companies provide by their treatment systems and management structures. These include a range of strategies through which issuers take advantage of opportunities for more effective resource use in their operations, such as recycling and water conservation. When put together, these elements can help improve competitive positioning and reputation, and make more capital available, increase revenue and lower financial and operating costs.

- Reduce risk in terms of operations, regulations, and reputation

Today consumers associate their purchase decisions with a company’s ESG impact. A well-designed water treatment is inclusive of overall facility risks related to operations, regulations, and reputation that it can treat. Like a long tern investor, a plant manager should implement the treatment technology only after cost-benefit analysis of that system. Non-availability of water can be huge operational risk, for which maximum quantity of effluent needs to be treated and reused. With increasing environment and sustainability awareness, regulatory and reputation risk are the most uncertain type of risk to the organization. This can only be avoided with crucial steps like regular audits of the system, replacing or retrofitting with new technologies in Effluent Recycling Systems.

- Management of waste/pollution cost

The treatment and disposal of effluent/pollution are extremely expensive for any company, especially in presence of limited supply of water in the future. If your institution has a well-designed water treatment system, it will help you save thousands of dollars each month in freshwater/wastewater costs in the future. Often, certain decentralized technologies are eligible for grants from state or federal authorities.

- Reduction of effluent treatment carbon footprint

Often effluent treatment process requires heavy equipment material and are energy intensive, resulting in loads of CO₂ emissions. Newer treatment technologies can result in highly valuable carbon offset credits if executed correctly. The reduction in carbon footprint can be achieved by operational changes, outlet gaseous stream treatment, and prevention through innovative configurations and processes to remove both organic matter and contaminants. To make this changes and retrofitting, you would require expert effluent manufactures. Compact Packages for Biological Treatment use less energy as compared to other traditional treatment methods. Retrofits can help reduce greenhouse emissions by using less GHG intensive equipment material, resulting in potentially lower CO2 emissions and lower energy use.

- Disclosure as part of Sustainability Reporting

Companies’ environmental, social, and governance (ESG) reporting requirements are fast rising, as are financial services firms’ mandated disclosures. The sustainability reporting standards like (Global Reporting Initiative) GRI describes Water and Effluents related disclosures under its standard GRI 303. Such certifications will be useful to gain long term investors with ESG ratings in perspective. This can be achieved with comprehensive treatment plants that has minimum liquid discharge or ZLD (Zero Liquid Discharge)

- Contribution towards SDG Goal 6

17 Sustainable Development Goals were established by the United Nations General Assembly in 2015, from which Goal 6 aims for “clean water and sanitation for all” by 2030. Treatment of waste water, recycling and reusing is one of the major steps that any organization or industry can do to achieve this goal. Recycling in water stressed areas can have major impact on your ESG score. There are numerous long-term socioeconomic advantages for the surrounding communities that can be reaped by the installation of ZLDs (Zero Liquid Discharge) in heavily polluting enterprises.

Businesses, as part of a global economy, are challenged with environmental and social challenges and must comply with a variety of rules. Investors now prioritize “responsible” and selected investments in companies with high ESG scorecards. ESG variables are essential in analyzing a company’s quality since they encompass a wide variety of issues that were previously not included in financial analysis. These non-financial factors are in fact majorly interlinked, where management of one factor can impact other with much better outcomes. When industries endeavour to comply with environmental legislation and broader concerns about sustainability, social criteria intersect with environmental criteria and governance. Setting up a Wastewater Treatment plant at your facility can significantly improve Environmental factor of water intensive industries. This would assure availability of water to people around and in future, minimizing social impact. Discharge of effluent within the limit would score points in good governance of the company. This gives water and waste water plant managers and community the opportunity to initiate communication about its importance to the board and integrate waste water management and treatment into their system at earliest.

We will increasingly assess ESG performance within our firms in the future and communicate those measures to current and potential investors, clients, and – in some cases – the general public. As a result, proactive management of these aspects in synergy with one another should be a vital part of maintaining a business’ value proposition in today’s competitive market. Strong ESG performance may provide organizations with a variety of competitive advantages, including a more stable investor base.

Please contact us for ESG, SDG, GRI, TCFD consulting or report making on

Email

Frequently Asked Questions

1) What are environmental, social, and governance ESG factors?

ESG stands for environmental, social, and governance. The phrase “environmental, social, and governance” (ESG) refers to a company’s corporate financial interests, which primarily centre on ethical and sustainable outcomes. ESG is a tool used by capital markets to assess businesses and forecast their financial success.

2) How can ESG governance be improved?

How to Improve Your Corporate ESG Rating

- Conduct an ESG readiness and resources assessment

- Complete a materiality assessment

- Engage key ESG ratings stakeholders

- Define your top ESG score priorities

- Determine budgets, headcount, and other resources

- Formalize ESG governance and develop policies

3) What is the main purpose of ESG?

ESG is a framework that aids stakeholders in understanding how a company handles opportunities and risks related to sustainability issues. ESG has developed from earlier movements that prioritized corporate generosity, pollution reduction, and issues of health and safety.

4) Who is responsible for ESG in a company?

Company management is accountable for putting ESG into practice; regardless of how competent the board and subcommittees are at overseeing ESG.

5) What are the components of ESG?

Environmental, Social, and Governance is the abbreviation for ESG. Investors are using these non-financial aspects more frequently as part of their analytical process to spot important dangers and expansion prospects.